The cannabis sector is a rapidly growing, but risky, marketplace but cannabis stocks like Veritas Farms Inc. (OTC: VFRMD) offer unique opportunities with a low risk profile

We know that when it comes to investments there is no such thing as a certain win. Every investment comes with associated risks and investing in emerging sectors, like cannabis stocks, is even more risky. Despite this there are times when the market is more likely to be forgiving than others and for investors with the long view, and a good sense of timing, there’s a solution that makes a lot of sense.

To sum the opportunity up in two words: Buy American.

Two convincing charts

Do the shares of companies that focus primarily on the US cannabis market really give their investors an advantage? Yes. There are two charts that provide a convincing argument for this. The first chart illustrates the big difference in the valuations of Canadian versus US cannabis stocks.

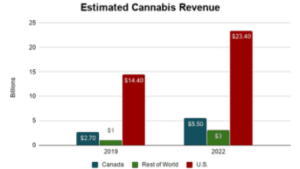

We cannot use yield-based valuation metrics because many cannabis stocks do not yet have positive results. But we can also use another common metric, the price-to-turnover ratio (P/S). The graph above clearly shows that Canadian cannabis stocks are valued much higher than their US counterparts. The average P/S ratio for Canadian cannabis stocks is almost three times higher than that of US cannabis stocks. Cronos Group, The Green Organic Dutchman and Emerald Health Therapeutics are mainly responsible for this. These three Canadian stocks have a much higher P/S ratio than their competitors. There is another compelling reason why US cannabis shares are a significant advantage for investors: the market opportunity. The following chart illustrates how much greater the market opportunities are in the US than in Canada or the rest of the world.

Most of Canada’s largest cannabis stocks can’t get involved in the US cannabis market unless marijuana is legal at the federal level. This means that US cannabis companies have a much larger market than most Canadian companies.

Let’s forget for a moment that we are talking about cannabis stocks here. If you knew that one type of technology stock has a much more attractive valuation and a much greater market potential than another type of technology stock, which would you rather buy? The problem with US cannabis companies is that they operate in US states that have legalized either medical or over-the-counter cannabis. But that doesn’t change the fact that many of these companies still violate federal laws. Those who do not violate federal laws bypass the issue because they are not directly involved in the production or sale of cannabis. Innovative Industrial Properties, for example, is a cannabis real estate investment fund (REIT) that only leases the real estate to US hemp companies. This legal question is the main reason why US cannabis shares are so much cheaper than their Canadian competitors.

The legal problem poses several challenges to many US cannabis companies. It restricts access to capital, prevents shares from being listed on the major U.S. stock exchanges, and makes companies vulnerable to the risk that the U.S. federal government could take action against them. However, these challenges are not as daunting as one might think. Many of the cannabis stocks that focus mainly on the US market have their shares listed on the Canadian Securities Exchange (CSE). This approach, combined with listing on over-the-counter exchanges in the US, has enabled companies to raise the funds needed to finance operations and expansion.

The risk of regulatory interference also appears to be fairly low at this time. There were some concerns at the beginning of the Trump administration, when Jeff Sessions was the US Attorney General. Nevertheless, there was no real action by the US federal government to annoy those companies operating in states where cannabis is legal.

Two basic assumptions

We really think the arguments for investing in US-focused cannabis stocks are good. However, you should know that there are two basic assumptions on which this approach is based: The US cannabis industry will grow in the approximate framework that many are providing. US federal laws will be revised in the not too distant future in a way that at least recognises the right of individual states to enforce their own laws on cannabis.

The first assumption is not too far-fetched. We can look at the sales curve of states like Colorado, where cannabis has been legally sold for several years, to get a realistic picture of how other cannabis markets might grow in the future. The second assumption, however, is a bit more uncertain. Support for the federal legalization of cannabis among the American public is higher than ever. The real question is exactly how intense this support is. It is not sure that most Americans would vote in a way that would make the candidates’ views on cannabis coincide with their own. Also because of the way the US political system works, the leader of the Senate or House of Representatives can ultimately object to any bill by refusing to put it to the vote.

But will federal marijuana laws change at some point? In our opinion this will happen in the foreseeable future.

The safe bet

If these two assumptions are correct, investing in US cannabis stocks should pay off strongly in the long run. My recommendation to anyone who opts for this approach should buy several shares of well-managed companies that are either already profitable or have a clear path to profitability.

GreenStar Biosciences Corp. (CSE: GSTR), an investment company from Canada that identifies and nurtures local cannabis competitors, is a good example of such company. Their strategy of helping promising companies succeed already brings results. Cowlitz is their flag success story. The leading Washington state-based producer and distributor of recreational cannabis recorded over $14 million last year (2018) in just five years of operations, and is well on track to deliver more in 2019.

GreenStar is also benefiting from their joint venture with Progressive Herbs Inc. called Capri. Capri is a sole owner of a patent-pending licence for their proprietary cultivation technology that allows to harvest high quality cannabis plants faster and cheaper than the competitors. It also keeps the highest THC levels available on the recreational marijuana market.

GreenStar is in the process of building a diverse portfolio of top cannabis companies that touch on every aspect of the product life cycle, making them accessible for investors with only one stock.

Shares of companies that focus on the hemp market is also a good idea, as hemp is already legal at the federal level in the US. Note, however, that the U.S. Food and Drug Administration (FDA) has not yet issued regulations for hemp-based CBD products. These regulations, if published, could change the prospects for some CBD companies.

The prospects of Veritas Farms Inc. (OTC: VFRMD) look very good. The company was founded in 2015 and has recorded an impressive growth in just four years of operations. By quarter two 2019, they generated more than $2.9 million in total revenue which is almost 500% more than their revenue in the same period a year earlier. Their gross profits jumped up to $1,523,413 by almost 800% and it allowed them to expand the operations and reduce liabilities by over $1.3 million.

Veritas Farms is a producer and distributor of eight categories of full spectrum, high quality hemp products that are available at 4,500 retailers across the U.S. including 1,350 Kroger Family of Stores locations. Their focus on honesty, transparency and high quality, combined with successful marketing campaigns, has brought them good results as well as additional funding. In September, the company secured $15 million via a private placement and is planning to use this money for further expansion efforts.

However, as mentioned at the beginning, buying US cannabis stocks is not a sure thing. But there is one thing one can be absolutely certain about: If you don’t invest in the cannabis industry, you won’t benefit from the boom in the cannabis industry.