Under 4 months ago, billionaire real-estate magnate Yakir Gabay sold 15% of his AroundTown stock to TLG Immobilien AG for €1.5 billion Euros.

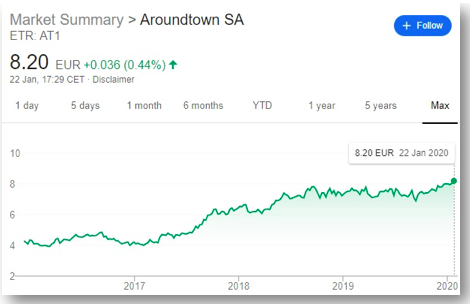

Yakir Gabay founded and listed AroundTown shares just 5 years ago on the Frankfurt Stock Exchange and Euronext, Paris at €3 per share with a market cap of €1.6 billion euros. Over the years, Aroundtown has significantly appreciated in value (ETR: AT1 – traded at ~€8.2 per share and rising) crossing the €10 billion euro market cap.

Aroundtown is the largest publicly traded commercial real estate public company in Germany and appears to be accelerating on its’ quest to becoming one of the largest real-estate companies in Europe.

Since Mr. Gabay’s €1.5 billion sale of stock to rival German real-estate TLG Immoblien, the companies began merger talks. The combined stock market value is €13 billion, producing around €1 billion annually in rent and over €600 million funds from operations (FFO). The objective behind combining the TLG-Aroundtown interests into one entity is to achieve over €100m in synergies, become a DAX blue chip company ranking amongst the top corporations in Germany and ultimately receive the esteemed “A” rating status from S&P.

After the merger discussions began, TLG Immobilien’s major shareholder, Mr. Amir Dayan, signed a contract to sell his TLG stock to Aroundtown in exchange for newly issued Aroundtown stock. On 24th January 2020, it was announced that Aroundtown received acceptance to exchange 70% of TLG shares with its newly issued shares.

The merger of combined real-estate and property management interests creats a €28 billion Pan-European market leader specializing in residential, hotel, and office properties.

According to SlaterSentinel and Marketbeat Ratings, the public stock shares of Aroundtown SA (ETR:AT1) have received “Buy” ratings from 14 global market research firms actively covering the corporations activities. The average annual target price amongst brokers over the past year is €8.70.

Aroundtown is not the only company Yakir Gabay founded. Mr. Gabay took public Grand City Properties SA. In mid 2012, Grand City Properties stock (ETR: GYC) was traded at €2.7 Euros with €150 million market cap, and has since appreciated by over 800% to its current price of €23 and €4 billion market cap, making Grand City Properties the fourth largest residential real-estate company in Germany.

According to real-estate market experts, UK property is expected to appreciate post-Brexit in value, which makes sense why Grand City Properties has accumulated over 2,500 apartments in London in addition to 80,000 acquired in Germany.